Introduction

The Carbon Border Adjustment Mechanism (CBAM) is a European Union regulation which has been introduced to reduce carbon emissions produced by manufactured goods imported from jurisdictions with less stringent carbon emissions regulations.

The regulation will affect Cooley clients importing fertilisers, energy products, hydrogen, cement, iron and steel, as well as carbon dioxide equivalent (CO2e) emissions connected to them. CO2e refers to ‘the number of metric tons of CO2 emissions with the same global warming potential as one metric ton of another greenhouse gas’, as defined in the upcoming legislation.

This blog post will cover the scope of the CBAM, its key provisions, timeline and next steps.

Scope of the CBAM

The CBAM applies to all imports of high-emission goods from non-EU countries and to companies which rely on imports of high-emission goods for their business. The CBAM specifically applies to cement, iron, steel, aluminium, some chemical industries (fertilisers and hydrogen) and electricity, which are imported into the EU.

The CBAM applies to all companies that import any of the included goods for any part of their business, not just to those who supply or deal exclusively with those goods.

The requirements which will come into force

Affected companies will be required to accurately report on their CO2e emissions, and after the transitional period, they also will be required to account financially for those emissions.

1.Reporting requirements

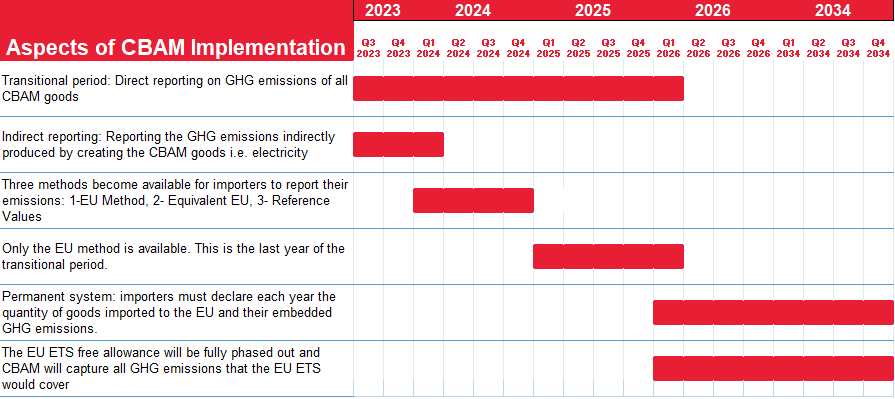

In the interim phase of implementation of the CBAM, from 1 October 2023 to 31 December 2025, affected companies will need to report on their carbon emissions. During this time frame, importers should determine and assess direct and indirect reporting. Direct reporting includes the greenhouse gas (GHG) emissions which the imports produce during production, and indirect reporting includes the emissions associated with the electricity used during production of the goods.

Affected EU importers are obliged to prepare a quarterly CBAM report that provides the information on the imported quantity of CBAM goods.

From 1 October 2023, companies will need to report on:

- The direct emissions within each CBAM imported good, including the annual embedded GHG emissions.

- The indirect embedded emissions contained therein (reporting on indirect embedded emissions is initially only for cement, electric power and fertiliser).

- The consistency throughout the value chain cycle – meaning that the number of CBAM certificates in the company’s CBAM registry account at the end of each quarter should correspond to at least 80% of the embedded emissions in imported products since the beginning of the calendar year.

- Any carbon taxes effectively paid in the country of production.

The first report should be submitted by 31 January 2024. Penalties may be put in place if an entity’s reporting is deemed insufficient by the European Commission.

2. Mandatory registration

As of 1 January 2026, it is mandatory for affected companies to register as declarants. Only registered declarants will be permitted to import any CBAM goods. This will be monitored by the customs authorities of each EU member state. They will be obliged to deny the import of CBAM goods by nonregistered declarants. The period to register begins on 1 January 2025.

3. Import charges and certificate trading

After January 2026, import charges will be imposed on companies importing CBAM goods. This will require importers to purchase CBAM certificates equal to the carbon content of the imports. These certificates serve as proof that the carbon emissions have been accounted for and offset.

When the company pays the relevant charges for its imported CBAM goods, any carbon offsetting price that the importer paid in the jurisdiction where the goods were manufactured will be allowed to be offset from the CBAM import charge.

Exemptions

The CBAM will not apply to:

- Imports from the European Economic Area (EEA) – Norway, Iceland, Liechtenstein and Switzerland.

- Small quantities of imported goods – i.e., under 150 euros per consignment.

- Downstream emissions.

- Emissions created by transporting materials between sites and from processes further upstream.

Next steps

As an immediate step, companies need to think about the reporting requirements that are kicking in on 1 October 2023. This will require them to determine, assess and document all direct and indirect emissions from imported CBAM goods. Additionally, in looking forward to the 2025 and 2026 requirements, companies should start assessing their production, supply chain and import practices to be CBAM-compliant.

Cooley lawyers will continue to monitor this space. Please reach out to the authors of this note or your regular Cooley contact if you would like to discuss further.